Dec 22, 2022

The misery of 2022 has continued when it comes to investor sentiment. In the latest weekly AAII poll, bullish sentiment declined from 24.3% down to 20.3%. That’s the lowest reading since the end of September and less than five points above the YTD low of 15.8% from mid-April.

As shown in the chart above, there hasn’t been a single week this year where bullish sentiment has been above its historical average of 37.6%, and the only week where sentiment was even close to its historical average was at the start of the year. With just one week left in the year, barring a historic one-week surge, 2022 will go down as the first year in the history of the AAII survey where there wasn’t a single week that bullish sentiment was above average. Talk about malaise. Click here to learn more about Bespoke’s premium stock market research service.

Dec 22, 2022

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Make a game plan and stick to it. Unless it’s not working.” – Yogi Berra

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Today is looking like a back-to-normal 2022 day for US stocks as futures are trading lower. The gains were fun while they lasted. Looking on the bright side, there are only five trading days left in the year. Elsewhere in markets, the 10-year yield is down slightly to 3.65% while oil has been quietly rallying and is now just under $80 per barrel.

The economic calendar is busy today as many reporting agencies try to squeeze in this month’s reports before Christmas. Data released so far hasn’t been particularly market-friendly as revised GDP came in higher than expected (3.2% vs 2.9%) and Core PCE was revised higher (4.7% vs 4.6%). Jobless claims were also strong with initial claims coming in lower than expected (216K vs 222K) and continuing claims also coming in slightly better than expected (1,672K vs 1,675K). If they were to have any impact on Fed policy, none of these reports would suggest less of a hawkish stance.

The more things change, the more they stay the same. Even after two days of gains, sector performance over the last five trading days has been pretty poor and almost exactly in line with performance rankings on a YTD basis. As shown in the scatter chart below which compares YTD performance versus the last week, there has been a clear correlation between the two with an r-squared of 0.78. Heading into year-end, investors are following the game plan of selling their losers and buying the few winners.

Looking at a snapshot from our Trend Analyzer, four of the S&P 500’s eleven sectors are down over 4% in the last week, another four are down more than 2%, two are down over 1%, and only Energy is higher. In terms of where sectors are now trading with respect to their trading ranges, there’s still pretty much of an even split between sectors trading above and below their 50-day moving average with six above and five below. Consumer Discretionary is the only sector in oversold territory. While that may seem like an ominous sign heading into the Christmas season, it’s worth remembering that retailers usually underperform at this time of year. Also, Tesla (TSLA) makes up about 13% of the sector, so the stock’s weakness has been a drag on the overall sector.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Dec 21, 2022

Log-in here if you’re a member with access to the Closer.

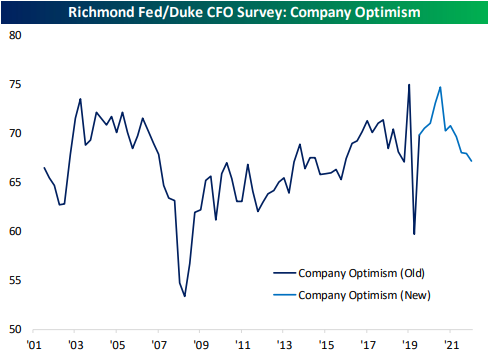

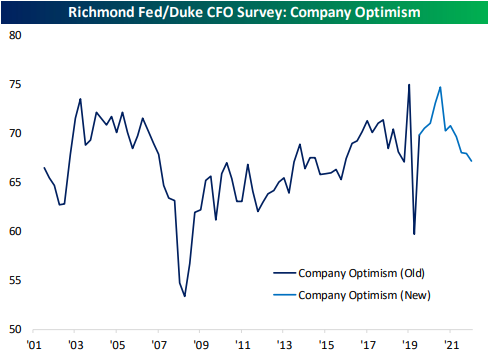

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we start out tonight with a look at the moves in credit markets, the VIX, ags, and FX (page 1). We then dive into the latest inflation numbers from Canada (page 2) as well as the US current account (page 3). Next, we provide a review of the latest CFO survey (page 4) followed by recaps of today’s 20 year bond reopening (page 5) and EIA petroleum stockpile data (page 6).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!