Bespoke’s Crypto Report — 12/23/22

Bespoke’s Crypto Report contains numerous technical, momentum, and sentiment charts for bitcoin, ethereum, and other key cryptos. Page 1 of the report includes our weekly commentary on the space and attempts to identify any new trends that are emerging. The remaining pages include important overbought/oversold levels to watch, charts on historical drawdowns and rallies, seasonality trends, futures positioning data, Google search trend shifts, and more. Our weekly Crypto Report is produced so that followers of the space can more easily stay on top of price action, technicals, seasonality, and sentiment.

Sign up for a monthly or annual subscription to Bespoke Crypto to receive our weekly Crypto Report and anything else we publish related to cryptos. Note: If you’re currently a Bespoke Premium, Bespoke Newsletter, or Bespoke Institutional subscriber, you’ll need to subscribe to Bespoke Crypto as an add-on to receive access. The weekly Crypto Report and any additional crypto analysis is not included with our Premium, Newsletter, or Institutional memberships. You can sign up for Bespoke Crypto and receive our Crypto Report in your inbox weekly using the monthly or annual checkout links below. If you sign up for the annual plan, the first year of access is 50% off!

Bespoke Crypto Access — Monthly Payment Plan ($49/mth)

Bespoke Crypto Access — Annual Payment Plan ($247.50 for the first 12 months, then $495/year in year 2 and beyond)

Bespoke Investment Group, LLC believes all information contained in this service to be accurate, but we do not guarantee its accuracy. None of the information in this service or any opinions expressed constitutes a solicitation of the purchase or sale of any securities, commodities, or cryptocurrencies. This service contains no buy or sell recommendations. This is not personalized advice. Investors should do their own research and/or work with an investment professional when making portfolio decisions. As always, past performance of any investment is not a guarantee of future results. Bespoke representatives or clients may have positions in securities discussed or mentioned in its published content.

How Did 2022’s Most Loved Stocks by Analysts Fare?

As we approach year end, today we looked at where analyst ratings stood for Russell 1,000 stocks at the end of 2021 to see how the most loved stocks at the start of the year ended up performing. Looking at just stocks with coverage from at least eight analysts, the average Russell 1,000 stock had about 59% buy ratings at the start of 2022.

Sixty-three Russell 1,000 stocks began the year with at least 90% buy ratings, while 52 stocks had less than 20% buy ratings. Those 52 stocks with less than 20% buy ratings are currently down an average of 10.7% YTD on a total return basis. The 63 stocks with 90%+ buy ratings are down an average of 22.8%.

The 38 stocks below had at least 92% buy ratings at the start of 2022. Of these 38, the 24 with 100% buy ratings are down an average of 32% YTD. The biggest of the “100% buy” stocks is Amazon (AMZN). At the start of 2022, all 59 analysts covering the name had a buy rating. It’s down just under 50% YTD as of this morning. Two of the 24 stocks with all buy ratings on 12/31/21 posted gains this year: Encompass Health (EHC) and Horizon Therapeutics (HZNP). That’s a “batting average” of under .100 with roughly 28% of Russell 1,000 stocks in the green on the year. Click here to learn more about Bespoke’s premium stock market research service.

As always, past performance is no guarantee of future results.

The Best and Worst Performing Stocks of 2022 (through 12/22)

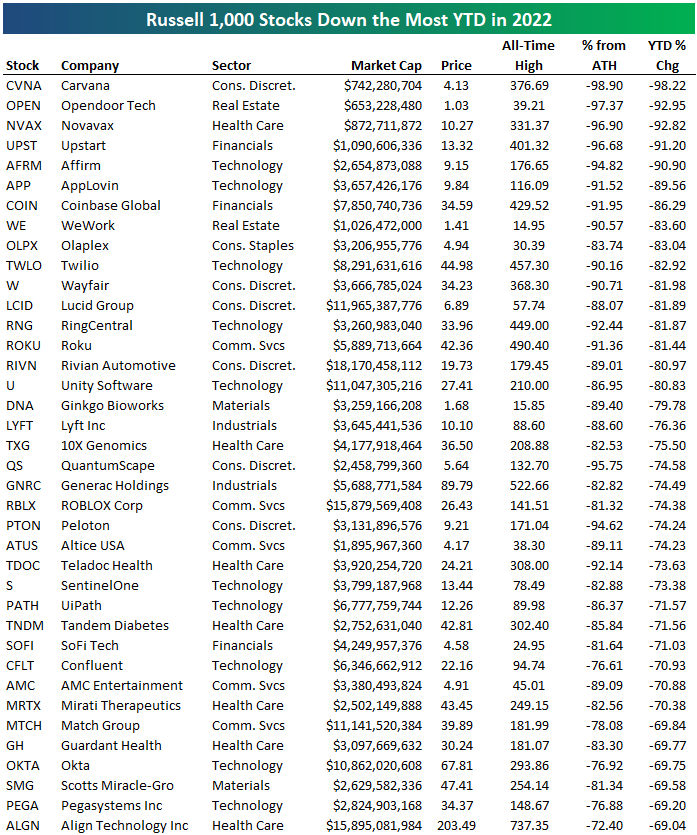

Below are lists of the best and worst performing Russell 1,000 stocks year-to-date on a total return basis. We’ll start with the worst first. Five stocks in the index are down more than 90% this year: Carvana (CVNA), Opendoor (OPEN), Novavax (NVAX), Upstart (UPST), and Affirm (AFRM). Another eleven are down more than 80%, which includes names like Coinbase (COIN), Twilio (TWLO), Wayfair (W), Lucid (LCID), and Roku (ROKU).

Seventy-two percent of stocks in the Russell 1,000 are down YTD, but below are the names that have bucked the trend and gained the most. Just three stocks are up more than 100% YTD: Occidental Petroleum (OXY), Signify Health (SGFY), and Texas Pacific (TPL). Of the 38 names shown, 23 are from the Energy sector, with big names like Exxon Mobil (XOM), Chevron (CVX), and ConocoPhillips (COP) included. Exxon’s 78.8% YTD gain is easily its biggest annual move higher since at least 1980. Merck (MRK) is the biggest of the non-Energy stocks that made the list with a YTD gain of 49.8%. Click here to learn more about Bespoke’s premium stock market research service.

As always, past performance is no guarantee of future results.

Russell 1,000 Stocks Down the Most from All-Time Highs

As we wrap up an awful year for the stock market, below we highlight a list of the current Russell 1,000 stocks that are the farthest below their all-time highs. For the index as a whole, the average stock is down 15.85% YTD on a total return basis, while the average stock’s price is about 38% below its all-time high.

About 30% of stocks in the Russell 1,000 are currently at least 50% below their all-time highs, while about 10% of index members are at least 75% below all-time highs. Below we list the 38 stocks that are all down at least 85% from their all-time highs and it includes Palantir’s (PLTR) 85.96% drop to Plug Power’s (PLUG) near evaporation of 99.2%. Most of these names have come down from all-time highs that were made at some point in 2021, although some like PLUG, AIG, and Citi (C) made highs a long time ago.

This list is a who’s who of stocks that got caught up in the post-COVID retail investor buying spree. A name like Carvana (CVNA) hit its all-time high of $376.69 relatively recently in August of last year. It’s at $4.13/share as of this morning. Upstart (UPST) traded above $400/share last October, and it’s at $13 and change now. Roku (ROKU) got up to $490.40 last summer and is at $42 now or more than a full decimal point to the left! Click here to learn more about Bespoke’s premium stock market research service.

As always, past performance is no guarantee of future results.