Dec 28, 2022

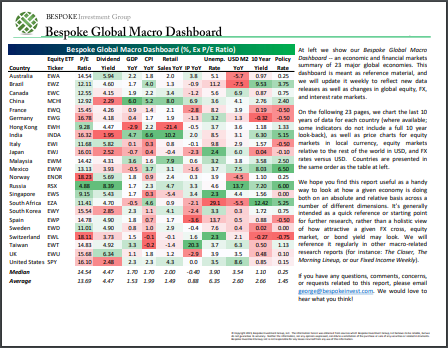

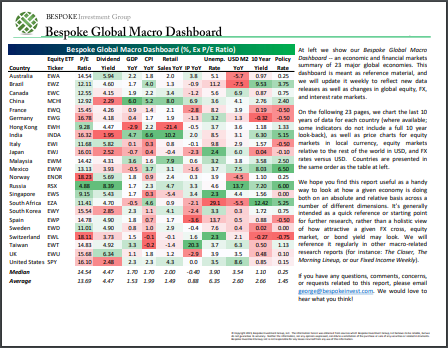

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published the last Wednesday of every month at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Dec 28, 2022

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I have no views as to where it will be, but the one thing I can tell you is it won’t do anything between now and then except look at you.” – Warren Buffett (discussing gold)

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

In case you missed it last Friday while you were out holiday shopping or stuck in an airport. We also emailed out our annual Bespoke Report which covers everything you need to know about the setup for financial markets and the economy heading into 2023. You can read it here.

Bespoke Report 2023

In a year when all the news tended to push stocks lower, it’s nice to see a day with little in the way of news. Equity futures are higher, bond yields are lower, and WTI crude oil is trading just below $80 per barrel after failing to get back above its 50-day moving average yesterday. The only economic data on the calendar today is Pending Home Sales and the Richmond Fed report, and both of those releases are at 10 AM. A lot of people take the last week of the year off, and one group we’re more than happy to see take a break are Fed officials.

Just like any other investment ‘rule’ there are always exceptions, and when it comes to Warren Buffett’s thoughts on gold, most of the time, he would be exactly right. Who would want to own an asset that has little industrial utility and provides no upside in terms if capital appreciation or income? If you want something that just sits there, get a dog.

Every once in a while though, something that just sits there doing nothing may be the best option, and that’s been the case in 2022. With just three trading days left in 2022, the S&P 500 is down close to 20% on the year and long-term US Treasuries are also down by close to a third. Gold hasn’t escaped 2022 unscathed, but with a decline of just over 1%, it’s been the least of all evils in what has been a nasty year for asset classes of all types.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Dec 27, 2022

Log-in here if you’re a member with access to the Closer.

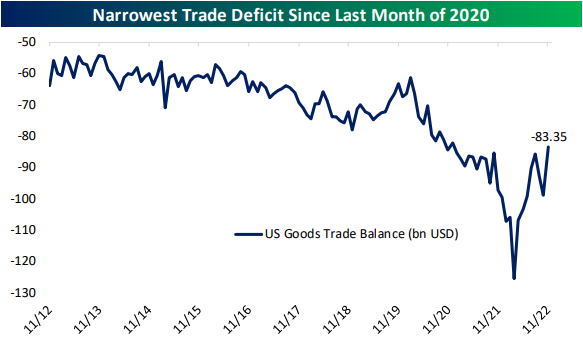

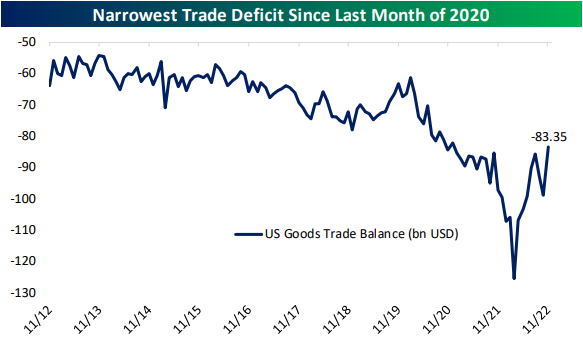

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, in tonight’s Closer, we begin with a note on valuations, volumes, and a decile breakdown of today’s price action based on year to date performance (page 1). Afterward, we discuss the trade surplus figures (page 2) followed by a look at the latest inventories data (page 3). Staying on the topic of macro data, we then show the continued drop in home prices (page 4).We then recap today’s stellar 2 year note auction as well as preview the other auctions slated for this week (page 5) before finishing with a rundown of the latest positioning data (pages 6-8).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!