Jul 27, 2016

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

This week, we investigate how carry (coupon) and roll (forward rates convergence) have changed for the US fixed income space over the past few years. Our trade idea focuses on US credit.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!

Jul 26, 2016

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we look at the yield curve. There are also four pages of charts on the Richmond Fed’s Manufacturing and Services indices, a summary of very strong New Home Sales today, and a brief preview of the FOMC meeting tomorrow.

The Closer is one of our most popular reports, and you can sign up for a trial below to see it and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!

Jul 26, 2016

Below is our daily list of the twenty best and twenty worst performing ETFs over the last five trading days. Oil dipped slightly, and even though gold rallied on the day, gold, oil, and commodity exposures generally were still among the worst performers on the week. Steel producers rallied from yesterday, and biotech stocks remained strong on the weak but didn’t move much today. Several China based exposure also joined the top performers, and Turkey slipped slightly after rallying yesterday. Biotech was up for the fifth straight day.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

Jul 26, 2016

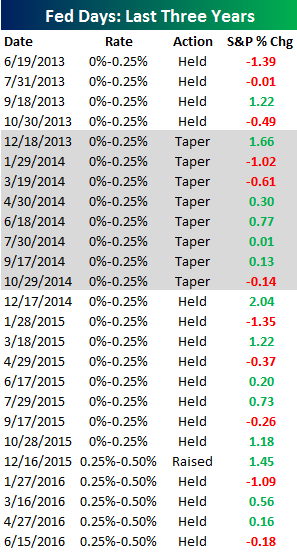

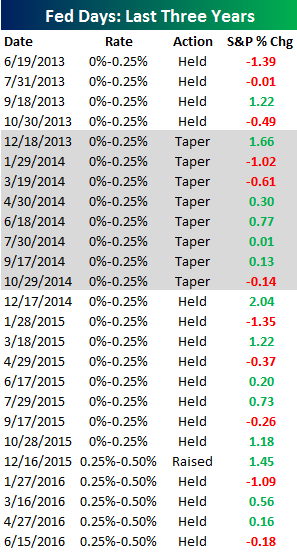

Earlier today, we sent Bespoke Premium and Bespoke Institutional members a brand new B.I.G. Tips report looking at historical market performance on Fed Days. Below is an abbreviated version of a table from the report that shows Fed Days over the last three years. You’d be amazed to see how the S&P 500 has done on Fed Days over the last 20 years. To see the stats, get signed up for a new Bespoke membership below!

See the full B.I.G. Tips report by signing up for a monthly Bespoke Premium membership now. Click this link for a 10% discount ($89/month).