Jul 27, 2016

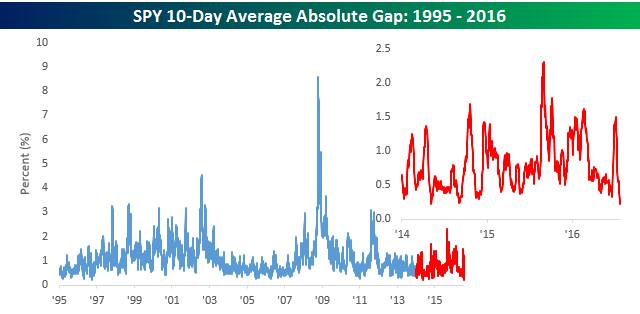

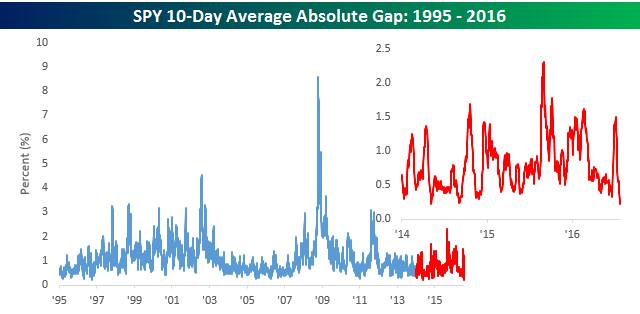

If you’re the type of person who turns on the financial news in the morning, you’ve likely noticed that on most days recently, futures have been little changed. In fact, using the S&P 500 tracking ETF (SPY) as a proxy, the S&P 500 has gapped up or down at the open by less than 0.2% for four straight days. And through yesterday, the ten-day average opening gap of SPY was a record low +/-0.215% (since 1994 when SPY started trading). To put this lack of volatility into perspective, the median opening gap for SPY going back to 1994 has been +/-0.76%!

In today’s Chart of the Day sent to paid subscribers, we look at periods where SPY had similar 10-day periods with low volatility at the opening bell and see how the market performed going forward. To view the report, please start a 14-day free trial below.

Jul 27, 2016

Below is our daily list of the twenty best and twenty worst performing ETFs over the last five trading days. Gold and other metals have had a solid run as have biotech names. South Africa has been the single best performer at the country level while European equity exposure has benefited from FX hedging. The worst performing ETFs have been oil and energy related, with coffee soft as well. Mexican equity have gotten hit as USDMXN has moved higher.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

Jul 27, 2016

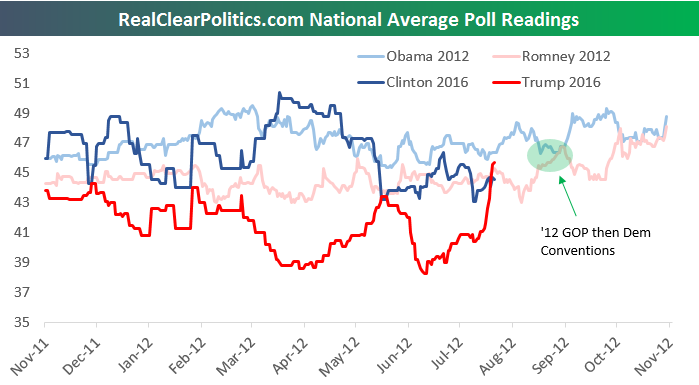

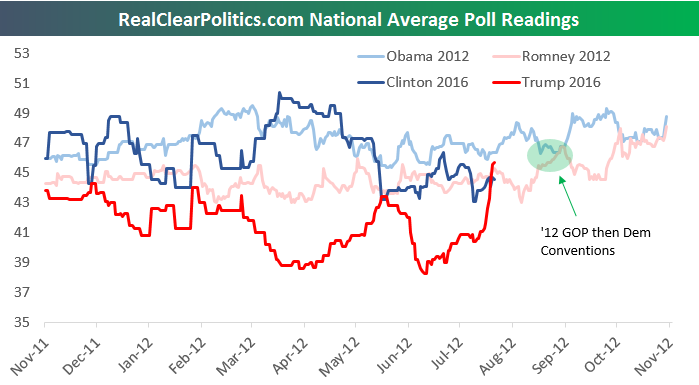

RealClearPolitics.com (RCP) is one of the best poll aggregation sites around, and we’ve been following its national general election poll tracker for years now. The tracker simply combines a basket of national Presidential election polls to come up with an average reading for each candidate. Over the last few days, Donald Trump has moved slightly ahead of Hillary Clinton in the RCP national average general election poll. At right we have charted the RCP tracker for Trump vs. Hillary going back to November 2015. As shown, Clinton pulled away from Trump in March and April, but since then the spread has mostly been tightening. At the end of May, Trump moved slightly above Clinton for a couple of days, but then Trump saw his numbers dip to their lows of the series in mid-June. Since those lows, Trump’s numbers have been spiking, and the RCP Trump tracker is at a new high of 45.7% today. Clinton, meanwhile, saw her tracker peak at 50% on March 24th, but her numbers have been range-bound between 43% and 46% since late May.

RealClearPolitics.com (RCP) is one of the best poll aggregation sites around, and we’ve been following its national general election poll tracker for years now. The tracker simply combines a basket of national Presidential election polls to come up with an average reading for each candidate. Over the last few days, Donald Trump has moved slightly ahead of Hillary Clinton in the RCP national average general election poll. At right we have charted the RCP tracker for Trump vs. Hillary going back to November 2015. As shown, Clinton pulled away from Trump in March and April, but since then the spread has mostly been tightening. At the end of May, Trump moved slightly above Clinton for a couple of days, but then Trump saw his numbers dip to their lows of the series in mid-June. Since those lows, Trump’s numbers have been spiking, and the RCP Trump tracker is at a new high of 45.7% today. Clinton, meanwhile, saw her tracker peak at 50% on March 24th, but her numbers have been range-bound between 43% and 46% since late May.

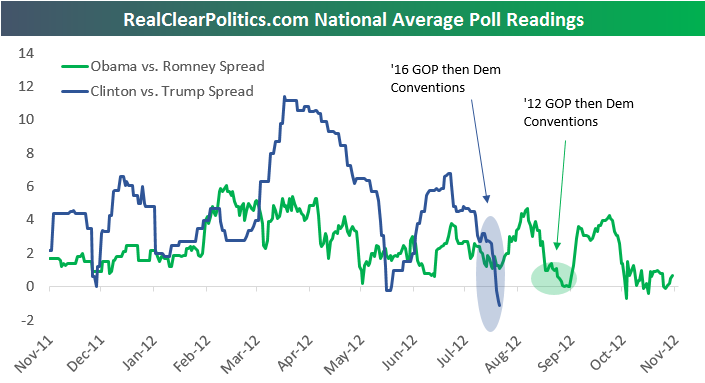

With Trump pulling slightly ahead of Clinton, we looked back at RCP’s national average poll for the 2012 general election to see where the GOP (Romney) and Democratic (Obama) candidates stood at this point in time in the cycle. One important difference between the 2012 and 2016 elections is the date of the party conventions. The 2012 conventions came much later in the cycle. Romney’s 2012 GOP convention ran from August 27th through August 30th, while Obama’s Democratic Convention ran the following week from September 3rd through September 6th. The GOP convention this year ran from July 18th through July 21st, while the Democratic convention began on July 25th and runs through the 28th.

Below is a chart comparing Trump’s RCP national average poll reading with Romney’s in 2012. (The x-axis dates reference the 2012 election so use 2015/2016 for Trump’s reading.) If anything, Trump has been a volatile candidate, and his poll numbers bear that out! While Romney saw swings of 2-3 points for months on end leading up to the election, Trump has seen his numbers swing by 6-7 points. Right now Trump is on the upswing, though. He saw a bounce leading up to the convention and another big spike right after the convention. As of today, July 27th, Trump’s RCP average is above Romney’s average on the same date in 2012. Remember, though, that Romney’s convention wasn’t until the end of August, and he too saw a bounce of a couple points in the immediate aftermath.

The Democratic convention is ongoing, and Clinton is certainly hoping for a bounce similar to the one Trump saw. Obama, Romney and Trump all saw post-convention bounces, so the expectation is that Clinton will see one as well. Even still, at this point in the 2012 campaign, Obama’s RCP average was a couple points above where Clinton is now.

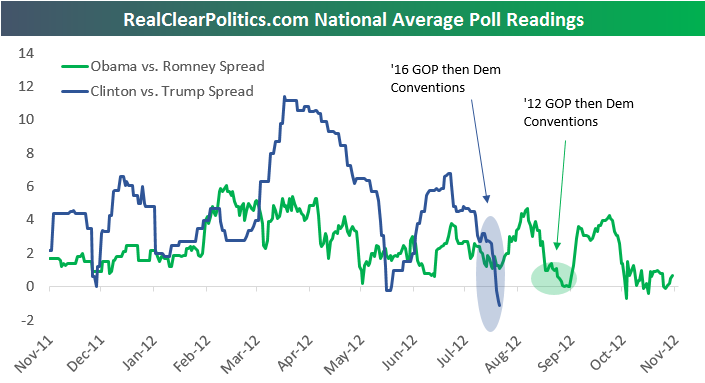

Below is a chart showing both sets of RCP average poll numbers for 2012 and 2016. The second chart shows the spread between the two candidates in each election. In the second chart, when the spread is in positive territory, it means the Democratic candidate has the lead over the GOP candidate. When the spread is in negative territory, the GOP candidate is ahead.

One thing you’ll notice in the spread chart is that Romney’s lead over Obama never got as big as the one Trump has over Clinton right now. However, the one time that Romney’s RCP average moved above Obama’s was immediately following the 2012 GOP convention. That lead evaporated the following week when the Democratic convention got underway. Will the same thing happen this time around? Only time will tell!

Jul 27, 2016

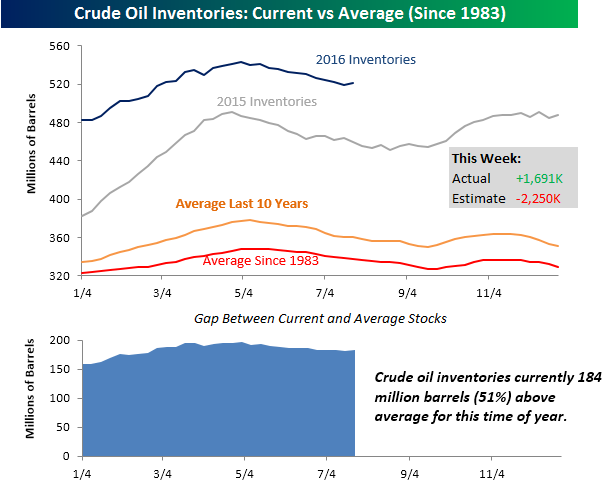

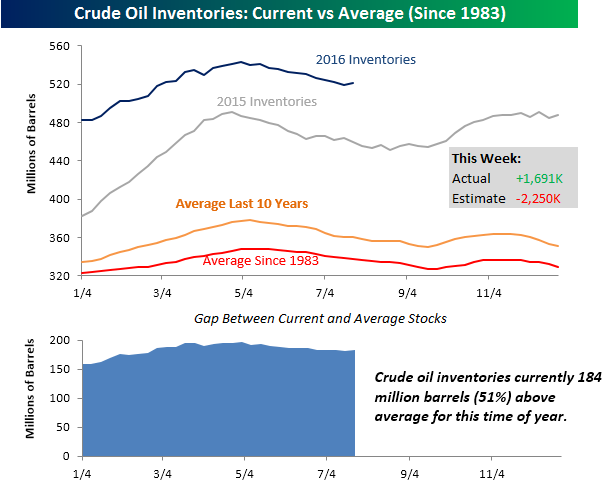

Crude oil prices dropped for a fifth straight day today, and the culprit this time around was a surprisingly large build in crude oil inventories. While traders were expecting stockpiles to decline by 2.25 million barrels, they actually increased by nearly 1.7 million barrels. As shown in the charts below, this week’s build comes at a time when stockpiles are typically in decline, although we would note that with a record nine straight weeks of inventory drawdowns, we were due for an increase. That being said, crude oil stockpiles are currently 51% above average for this time of year and with rig counts increasing, that has put some downward pressure on prices.

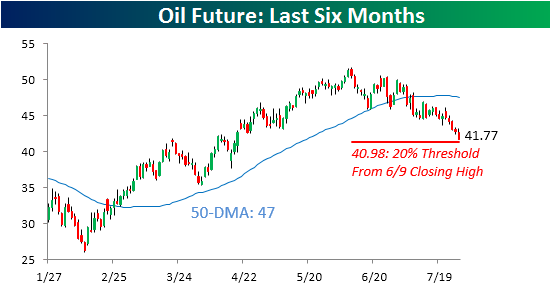

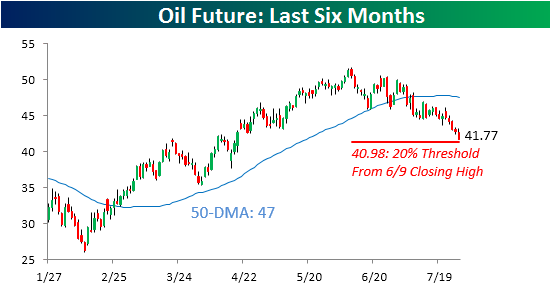

The pressure on prices has been especially strong in recent days. The pace of declines in crude oil has picked up steam this week, and at a current level of $41.77 is less than $1 from falling into bear market territory (20% decline from closing high of 51.23 back on 6/9).