Dynamic Upgrades/Downgrades: 7/28/16

This content is for members onlyBullish Sentiment Declines

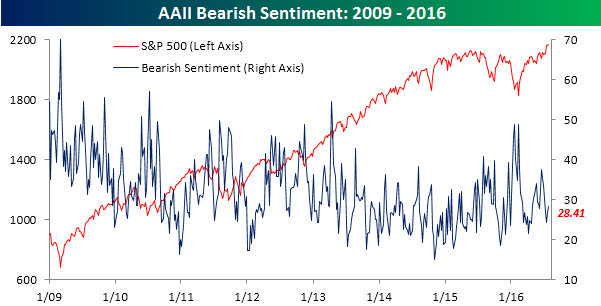

It may be hard to imagine, but while it may seem as though stocks have been doing nothing but going up, the S&P 500 is currently at the same level now that it was at two weeks ago. Granted, the two weeks or so prior to that saw a strong rally, but with stocks just hanging around right near record levels, individual investors have become increasingly antsy. According to the weekly survey from AAII, bullish sentiment declined from 35.43% down to 31.25%, marking the 39th straight week of below average bullish sentiment. If the July rally couldn’t boost sentiment above 40%, we certainly shouldn’t have expected a sideways market to do the trick!

While bullish sentiment declined by over four points, bearish sentiment increased by a more modest amount, rising from 26.72% up to 28.41%. The majority of investors who left the bullish camp moved into the neutral camp as that category increased from 37.85% back up above 40.34%.

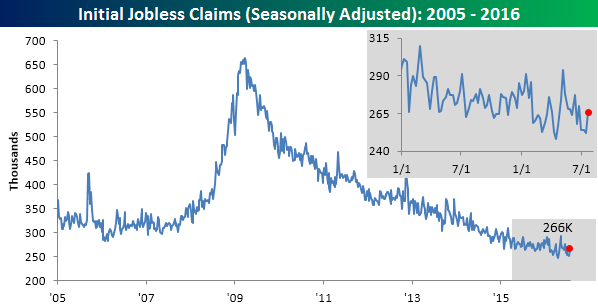

Jobless Claims Rise More Than Expected

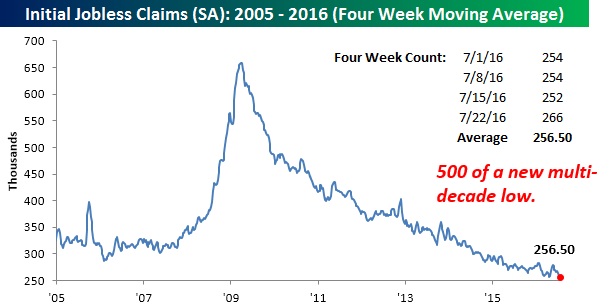

Jobless claims for the latest week rose more than expected, hitting a level of 266K versus economists’ expectations of 262K. While this morning’s report was the highest weekly reading for the month of July, it is still low by historical standards and represents the 73 straight week that first-time claims were below 300K. That’s the longest streak of weekly readings with a ‘2’ handle since 1973.

While claims were up this week, the four-week moving average declined to 256.5K, which is less than 1K from its post-recession low of 256K 14 weeks ago in April. In order to get a new low in this reading, though, next week we will need to see claims drop below 252K; it’s possible but not likely.

On a non-seasonally adjusted (NSA) basis, claims fell to 231.3K. That’s more than 100K below the average of 339K for the current week of the year since 2000. While this week’s NSA reading was low, it was actually slightly lower for the same week last year (230.3K), but that was the lowest weekly reading for the current week of the year since 1969.

The Closer 7/27/16 – Meh-ff OMC

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we review today’s FOMC decision, including a full breakdown of cross-asset price reaction and commentary. We also summarize releases today from the National Association of Realtors and the Advance Manufacturers’ Sales, Inventories, and New Orders report commonly referred to as Durable Goods.

The Closer is one of our most popular reports, and you can sign up for a trial below to see it and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!