Jul 29, 2016

Earlier today on Twitter, we asked people which S&P 500 company they thought had the most mentions of the term Brexit in their quarterly earnings conference call. The answer to that question was Goldman Sachs (GS), where the term was mentioned 22 times during its call! In today’s Chart of the Day sent to paid subscribers, we provided a summary of S&P 500 companies that have mentioned the term Brexit in their earnings conference calls grouped according to sector. As you might imagine, companies from some sectors made numerous mentions of Brexit in their conference calls, while among companies in other sectors, it was barely mentioned. To see the results of our analysis in today’s Chart of the Day, please start a 14-day free trial below.

Jul 29, 2016

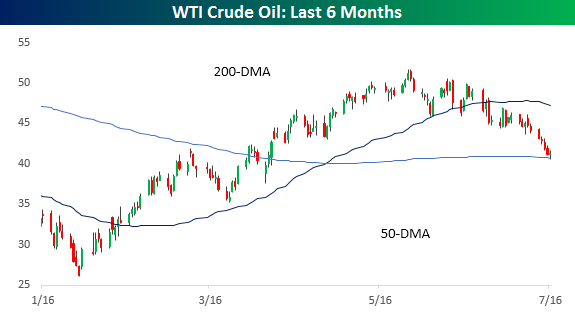

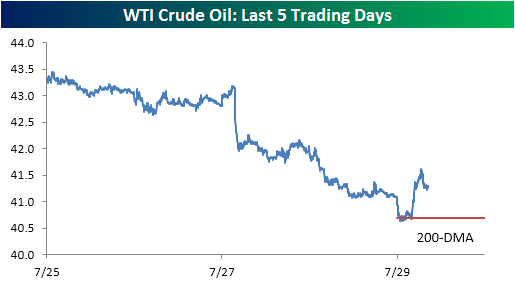

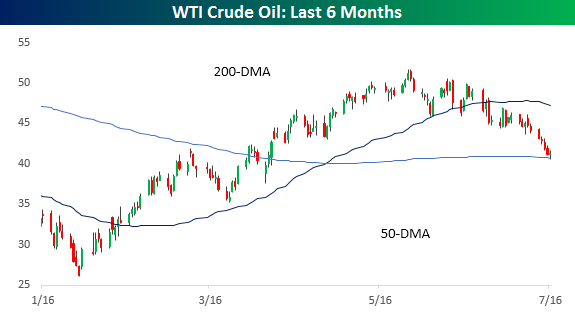

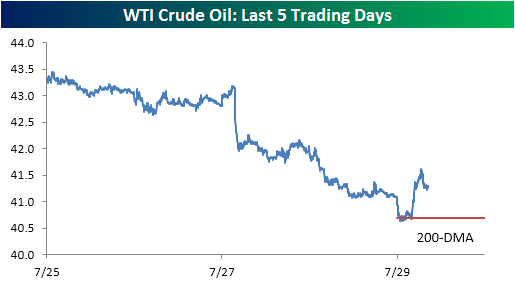

After briefly touching bear market territory earlier in the session, crude oil prices have caught a bounce intraday, taking WTI out of bear market territory (20% decline from closing high of $51.23). Despite the bounce, though, crude oil is still down 19.5% from its 2016 high, so it’s still very close to entering a new bear.

Taking a closer look at trading in crude oil this week, below we show an intraday chart over the last five days. In this chart, you can clearly see that today’s bounce (which is the biggest bounce we have seen all week) came just as prices touched on their 200-DMA as buyers stepped in at support. Now, can the bounce hold?

Jul 29, 2016

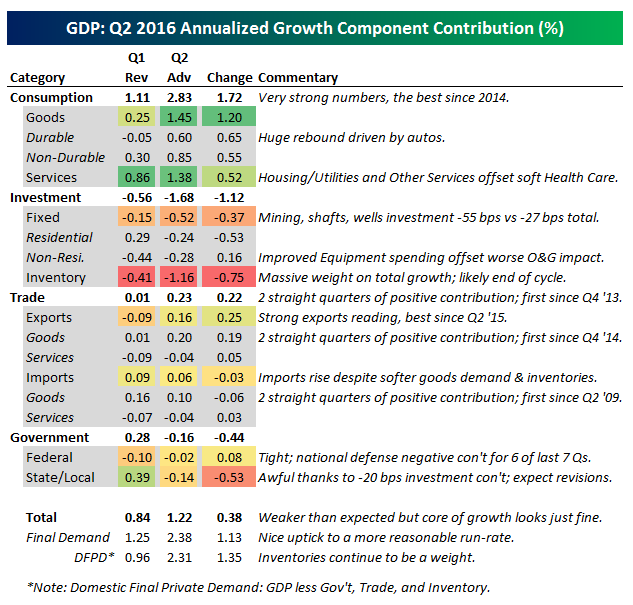

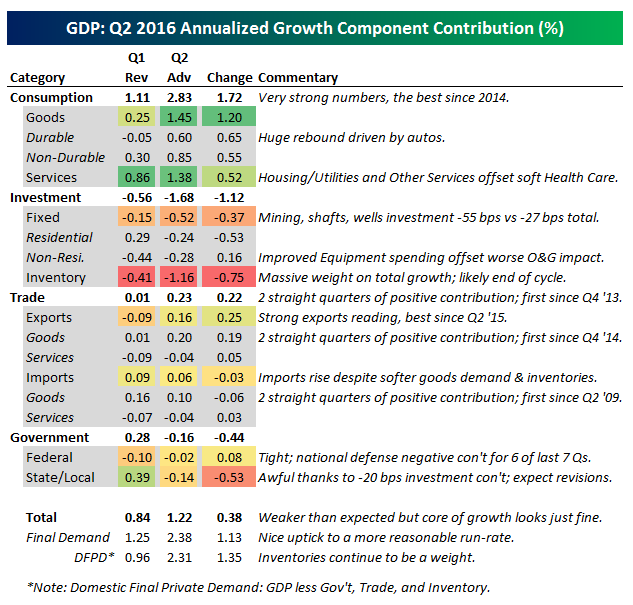

As we noted in our previous post on GDP this morning, headline GDP has been extremely disappointing versus expectations for the last two years. Even the normally very accurate Atlanta Fed’s GDPNow tracker missed today’s Advance GDP reading from the BEA by a mile. GDP grew 1.22% QoQ SAAR in Q2, versus 2.4% expected from Wall Street economists and 1.8% on the GDPNow tracker.

The guts of the report have some results that were expected, and some that were not. Consumption surged to the highest growth rate since 2014 in Q2, adding over 2.8% to total growth in the quarter. That’s a significant ramp from Q1, with autos and Housing/Utilities as well as Other Services pushing the figure up. Health Care spending softened. It’s also worth noting health care services inflation as measured by PCE is up 1.03% YoY versus 1.59% for core PCE in aggregate; in other words, slow health care inflation is pushing down inflation, contrary to the broad narratives on inflationary forces within the sector. Other components were much less strong than consumption.

Investment plunged, mostly due to a collapse in inventories. Nominal inventory/sales ratios for private industries and nonfarm inventories are at their lowest levels since Q2 2004 and Q4 2003, respectively, while real inventory/sales ratios of those two series both fell for the first time since Q3 2014. In short, there isn’t a lot of room for inventories to fall much further from the levels where they currently sit across the whole economy. There have also been 5 straight quarters of negative inventory impact on GDP averaging 60 bps per quarter. As always, inventories are a temporary headwind/tailwind for GDP, and it’s hard to envision the current -1.16% impact on growth continuing at anything close to the same pace over the next couple of years. Nonresidential investment improved versus Q1, but was still a headwind of 28 bps, while residential investment unexpectedly hit GDP by 24 bps. With new home sales accelerating to new post-recession highs in June and strong single family building activity, we don’t believe it’s possible for this series to continue dragging down GDP. Oil & gas continued to weigh on GDP.

Trade was possibly the most interesting point in the report. In Q1 and Q2 goods imports, goods exports, and total trade all made positive contributions to growth. As noted in the table below, occurrences where all three have had a positive contribution have been infrequent. We note that with inventories declining and real final sales strong, imports did not spike; the inventory supply chain is not extremely strong. We also note that solid real goods export growth suggests a slightly better global demand picture than we had previously been lead to believe.

Finally, government spending was extremely weak this quarter, especially versus Q1. Federal government expenditures have now been a headwind for growth for two straight quarters though that gap shrunk slightly this quarter. National defense has been a negative contributor for almost two years straight! Meanwhile, state and local governments unwound strong spending last quarter with a -20 bps investment contribution alone as outlays on infrastructure declined. In our view, that’s completely unsustainable and will likely be revised away. Other sections of the report that seem to be prime candidates for revision include residential investment, services consumption, inventories, and imports.

Don’t follow @bespokeinvest on Twitter yet? Below we’ve included our tweets with snap reaction to the GDP report today. Make sure to follow us for real-time updates on economic data and market action as it unfolds!