B.I.G. Tips – Caterpillar Sales Show Some Improving Trends

This content is for members onlyDynamic Upgrades/Downgrades: 7/25/16

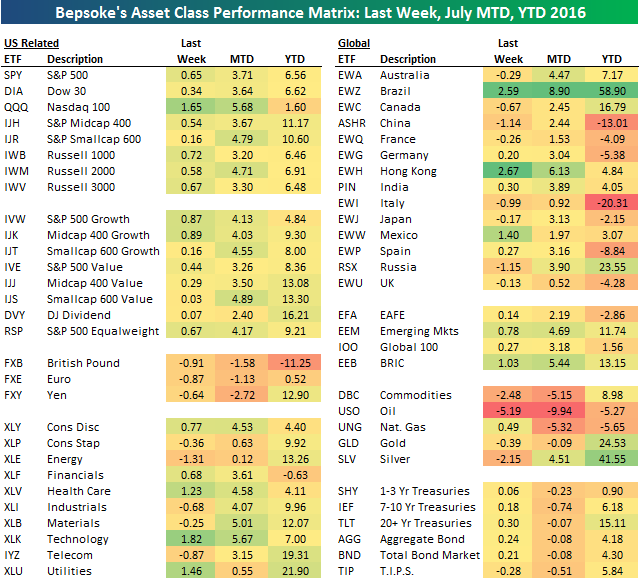

This content is for members onlyBespoke’s Asset Class Performance Matrix — 7/25/16

Below is an updated look at our asset class performance matrix using key ETFs traded on US exchanges. For each ETF, we show its performance last week, month-to-date, and year-to-date. The Nasdaq 100 is leading the list of US index ETFs in July with a gain of 5.68%. Small-caps have outperformed large and mid-caps, while growth has outperformed value. Most sectors are up anywhere from 3-5% on the month, but Consumer Staples, Energy and Utilities are only slightly in the green.

Outside of the US, Brazil continues to surge, gaining 2.59% last week for a total jump of 8.9% this month. On the year now, Brazil is up 58.90%! On the downside, Italy (EWI) is down the most YTD of any ETF in the entire matrix with a loss of 20.31%. After a huge recovery off its lows earlier in the year, oil continues to dip here, falling 5.19% last week and nearly 10% month-to-date. Gold and silver both pulled back a bit last week as well. Finally, Treasury ETFs remain up on the year, but they’re now down slightly in July.

Bespoke Brunch Reads: 7/24/16

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Brexit

Straws in the wind (The Economist)

Using the highest frequency of high frequency indicators, it appears that while consumer spending has not been hurt by Brexit, businesses are either putting off hiring, cutting staff, or putting off investment. [Link; registration required]

Economic Review: July 2016 Annex A (UK ONS)

The UK’s Office of National Statistics has published a simple and straightforward summary of forthcoming data releases and which periods they cover to help properly contextualize the impact of Brexit on economic data. [Link; note, Annex A is at the bottom, some browsers will not load at that point on the page so please scroll to bottom to view]

Brexit Wreaks Havoc on U.K. Economy as Recession Risk Increases by Jill Ward (Bloomberg)

This week’s Markit Flash PMIs were a significant indication that Brexit has hurt confidence and the expectations (as well as current activity) of businesses across the UK. [Link; auto-playing video]

Brexit, the Target2 angle by Izabella Kaminska (FT Alphaville)

Kaminska explores the seignorage and payment systems implications of the Brexit decision; we won’t try to summarize but do recommend the piece. [Link]

Economics

Summer Camp For Econos by Claudia Sahm (Postagon)

An overview of Sahm’s prep for the NBER Summer Institute, which includes an overview of recent research and some fun thoughts on the connection between economics and life. [Link]

The Empirical Economics of Online Attention by Andre Boik, Shane Greenstein, and Jeffrey Prince (NBER Working Papers)

Time spent online is inversely correlated to income when controlling for other factors, making it an inferior good per this excellent micro-data analysis. [Link, 50 pg PDF]

Politics

Kaine’s Wikipedia Page Edits Spike, Following Past VP Pick Trend by Danielle Bernstein (Bloomberg)

Ahead of the announcement of Virginia Senator Tim Kaine as Hillary Clinton’s running mate, edits on his Wikipedia page rose dramatically, suggesting that it was being “prepped for prime time”. [Link]

Real Estate

Why Land and Homes Actually Tend to Be Disappointing Investments by Robert Shiller (NY Upshot)

While housing and land (collectively, real estate) have traditionally been seen as highly stable, reasonably profitable investments, one of the greatest modern asset pricing thinkers has other ideas. [Link; paywall]

Gas Stations Are Going Extinct In Manhattan by Kristen Lee (Jalopnik)

The ground beneath gas stations in New York City has outpaced their revenues, making it increasingly difficult if not impossible to fill up downtown. [Link]

Strange But True

Pablo Escobar’s Hippos Keep Having Sex and No One Is Sure How to Stop Them by Sarah Emerson (Vice Motherboard)

Drug kingpin and international organized crime don Pablo Escobar once imported a number of hippos into his compound in Colombia. Now, some of the massive animals have escaped and are officially the world’s largest (as well as possibly most dangerous) invasive species. [Link]

The $4 Million Battle Over Inflatable Pool Toys by Polly Mosendz (Bloomberg)

Sellers on Amazon have recently tried to hawk imitation versions of giant inflatable pool toys pioneered by BigMouth Inc. Is this story a bit goofy? Yes. Is it entertaining and interesting? We think so! [Link]

Latin America

My Venezuela Nightmare: A 30-Day Hunt for Food in a Starving Land by Fabiola Zerpa (Bloomberg)

A textual and photographic account of a week spent looking for food in inflation-stricken and socialism-wracked Venezuela. [Link]

Lessons for restoring the American dream from Latin America by Carol Graham (Brookings)

Western nations are facing populist anger over amongst other things, income inequality, but the perceived hotbed of inequality and political strife, Latin America, is in the opposite position. The middle class is growing and the social contract appears to be deepening; we draw special attention to Figure 1 in the article to follow. [Link]

Dollar Shave Club

Unilever Gets More Than a Name in Dollar Shave Club by Saabira Chaudhuri (WSJ)

This week the European consumer goods giant purchased a Silicon Valley “subscription model” shavng business for 10 figures. Here’s a bit of background on why that purchase might have happened. [Link; paywall]

Dollar Shave Club And The Disruption Of Everything by Ben Thompson (Stratechery)

We don’t necessarily believe the purported implications of this piece and the embedded reasoning but we think it’s fair to describe it as the “bull case” for why Dollar Shave Club was purchased. [Link]

Sports

U.S. Olympic fencer Ibtihaj Muhammad: ‘I’m just your basic Hijabi Zorro’ by Johnnette Howard (ESPN)

US Olympic fencing contender Ibtihaj Muhammad is a pioneer for American Muslim athletes and a fascinating personal story; a great preparatory read on the road to Rio! [Link; auto-playing video]

Long Reads

The Mystery of Urban Psychosis by Vaughan Bell (The Atlantic)

Paranoia and schizophrenia are both more common in dense urban areas, with all sorts of important questions for psychiatrists and implications for policymakers. [Link]

Blue Flames and Volcanic Hikes: the Harsh, Spectacular World of Sulfur Mining by Ranjeetha Pakiam (Bloomberg)

There aren’t many substances that are mined inside active volcanos under the watch of adventure tourists, but sulfur isn’t just any material. An amazing trip to East Java, Indonesia. [Link]

Oil in the Can by Eric Banks (Lapham’s Quarterly)

A fascinating walk through the history of horse race handicapping and the race to beat the house. [Link]

Investing

A Little-Noticed Kink in Smart-Beta ETFs Might Blindside Buyers by Dani Burger (Bloomberg)

Isolating single factors for performance amongst groups of stocks is very, very hard. That’s especially true for “smart beta” ETFs which purport to provide passive exposure to specific kinds of equity risk. [Link]

Financial Crime

HSBC Currency Trader Got Greedy on Christmas by Matt Levine (Bloomberg View)

As usual, Matt Levine is the best read on financial misconduct, in this case the allegations against the head of spot FX trading for HSBC that was recently charged with wire fraud in connection to an alleged abuse of a client related to a large sterling trade. [Link]

Banking

Italy’s bail-in headache by Silvia Merler (Bruegel)

An excellent overview of the current problems in the Italian banking sector which are much more about regulation and legal structure than they are about bad loans. [Link]

The Economics of the Young

Why Is Childcare Getting Even More Expensive? by Rebecca Greenfield (Bloomberg)

The cost of childcare isn’t just about wages, isn’t just about regulation, and isn’t just about a lack of economies of scale, but rather a combination of all these factors plus a little bit more. [Link]

Investing In Higher Educations: Benefits, Challenges, And The State Of Student Debt (Council of Economic Advisors)

An exhaustive overview of the economics of borrowing for education, including the current and innate challenges as well as the current Administration’s policy changes. While produced by an inherently political organization, this is an excellent resource for anyone interested in student loans. [Link, 77 pg PDF]

Stagnation Generation: the case for renewing the intergenerational contract by Laura Gardiner (Resolution Foundation)

This piece uses UK data but carries a very strong set of lessons for the US and other developed market. In our view, the conclusions are very worthwhile; society currently under-invests in the young and the economic impact is already being felt. [Link]