Q1 2024 Earnings Conference Call Recaps

Bespoke’s Conference Call Recaps provide helpful summaries of corporate conference calls throughout earnings season. We go through the conference calls of some of the most important companies in the market and summarize key topics covered by management. These recaps include information regarding each company’s financial results, growth by segment, as well as some aspects of the business that management expects to impact future results. We also identify trends emerging for the broader economy in these recaps.

Bespoke’s Conference Call Recaps are available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call recaps. To sign up, choose either the monthly or annual checkout link below:

Bespoke Institutional – Monthly Payment Plan

Bespoke Institutional – Annual Payment Plan

Below is a list of the Conference Call Recaps published during the Q1 2024 and Q4 2023 earnings reporting periods.

Q1 2024 Recaps:

General Motors: Q1 2024

Tesla: Q1 2024

PepsiCo: Q1 2024

Cadence Design: Q1 2024

American Express: Q1 2024

Netflix: Q1 2024

D.R. Horton: Q2 2024

CSX: Q1 2024

Las Vegas Sands: Q1 2024

United Airlines: Q1 2024

ASML: Q1 2024

Big Banks (JPM, C, GS, BAC, MS): Q1 2024

Delta Air Lines: Q1 2024

Lamb Weston: Q3 2024

Conagra Brands: Q3 2024

Q4 2023 Recaps:

Williams Sonoma: Q4 2023

Nordstrom: Q4 2023

AeroVironment: Q3 2024

Aaron’s: Q4 2023

NVIDIA: Q4 2024

Walmart: Q4 2024

Home Depot: Q4 2023

Deere: Q4 2023

Generac: Q4 2023

Airbnb: Q4 2023

AutoNation: Q4 2023

Restaurant Brands International: Q4 2023

Shopify: Q4 2023

Cloudflare: Q4 2023

Hershey: Q4 2023

Disney: Q1 2024

Arm: Q3 2024

Uber: Q4 2023

Chipotle: Q4 2023

Spotify: Q4 2023

Simon Property: Q4 2023

Palantir: Q4 2023

Caterpillar: Q4 2023

McDonald’s: Q4 2023

Apple: Q1 2024

Amazon: Q4 2023

Meta Platforms: Q4 2023

Honeywell: Q4 2023

Old Dominion Freight: Q4 2023

Starbucks: Q1 2024

Microsoft: Q2 2024

United Parcel Service: Q4 2023

Alphabet: Q4 2023

Whirlpool: Q4 2023

Super Micro Computer: Q2 2024

Norfolk Southern: Q4 2023

American Express: Q4 2023

IBM: Q4 2023

Tesla: Q4 2023

ASML: Q2 2024

Texas Instruments: Q4 2023

Netflix: Q4 2023

RTX: Q4 2023

3M: Q4 2023

General Electric: Q4 2023

Schlumberger: Q4 2023

PPG Industries: Q4 2023

Taiwan Semiconductor: Q4 2023

H.B. Fuller: Q4 2023

Fastenal: Q4 2023

Big Banks (JPM, C, BAC, GS): Q4 2023

Delta Air Lines: Q4 2024

Constellation Brands: Q3 2024

Conagra Brands: Q2 2024

Lamb Weston: Q2 2024

Walgreens: Q1 2024

FedEx: Q2 2024

Costco: Q1 2024

Brown-Forman: Q2 2024

SentinelOne: Q3 2024

Recaps published during Q1 2024 are available with a Bespoke Institutional subscription.

SPY Gaps Down by Weekday

US equity futures were already significantly lower on earnings weakness from Meta (META) prior to the 8:30 AM ET release of today’s key economic indicators, but they took another leg lower after Q1 GDP came in much weaker than expected and PCE came in hotter than expected. Weaker economic growth and higher inflation are certainly not bullish for equities.

With about 15 minutes to go before the opening bell at 9:30 AM ET, the S&P 500 ETF (SPY) is trading down more than 1% in the pre-market.

Below is a look at all prior gaps down of 1%+ at the open for SPY since it began trading in 1993. This would be the 352nd opening gap down of 1%+ for SPY in the last 31 years, and on average, SPY has traded up 0.09% from the open to the close on these days with positive returns 51.4% of the time.

This would be the 68th time that SPY has opened down 1%+ on a Thursday, and on Thursdays specifically, SPY has averaged an open-to-close decline of 0.10% with positive returns 47.1% of the time.

As shown in the table, Friday gaps down of 1%+ have historically been followed by the biggest intraday bounce-backs (+0.39%), while Monday has been the worst weekday for bounce-backs with an average open to close decline of 0.20% after 1%+ gaps down.

This will be the 14th time that SPY has gapped down 1%+ during the current bull market that began in October 2022. On these days, SPY has averaged an open-to-close gain of 0.21% on days when it gaps down 1%+. (That makes sense, though, since it’s a bull market.)

Bespoke’s Morning Lineup – 4/25/24 – Low Growth, Higher Prices

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Move fast and break things. Unless you are breaking stuff, you are not moving fast enough.” – Mark Zuckerberg

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

After three days of gains, a fourth doesn’t look likely today. The largest drag this morning is Meta Platforms (META) which is down over 15% after the company announced that Q2 revenues would be at the low end of prior forecasts and that expenses would rise more than expected. META isn’t in the Dow, so it’s not to blame for the 300+ point decline in those futures, but a 4% decline in shares of Caterpillar (CAT) and a 9% drop in shares of IBM are making their presence felt.

Besides the slew of earnings reports last night and this morning, we also have a lot of economic data to contend with. At 8:30, Q1 GDP, Personal Consumption, Core PCE, Wholesale Inventories, and Jobless Claims were all released. While jobless claims were better than expected, GDP came in weaker than expected (1.6% vs 2.5% estimate) but inflation readings were higher than expected, and that was followed by another leg lower in the futures. At 10 AM, the latest update on Pending Home Sales will be released followed by the 11 AM report on manufacturing from the KC Fed.

When it comes to breaking things, one thing Mark Zuckerberg has broken more than a few times is his company’s stock price. Based on where the stock is trading today, the market cap of META is on pace to decline by more than $100 billion for the third time in 2018 and the second time since the start of 2022. While all but a small number of companies in the world could only dream of reaching a market cap of $100 billion, META loses that much money in market cap about once every other year! That’s not to say that shareholders are upset with these declines- at least they shouldn’t be. Shareholders are feeling a bit bruised this morning, but from the start of 2018 through yesterday’s close, META’s stock is up 180% which is just about double the gain in the S&P 500. That margin of outperformance is narrower this morning, but there’s still a wide gap.

The chart below shows the one-day change in market cap in reaction to META earnings reports since the start of 2018. As mentioned above, today’s decline will be the third time that the company lost $100 billion in market cap in a single day. That includes the largest ever one-day decline for any US stock ($232 billion) in February 2022 (according to Investopedia). Besides the big one-day declines, META also owns the bragging rights to the second-largest ever single-day increase in market cap (according to Bloomberg) when it saw its market cap increase by $197 billion this past February. The only company ever to see a larger one-day increase in market cap was Nvidia (NVDA) when it added $277 billion also in February.

In pre-market trading, shares of META are around $423 per share which is down sharply from its recent highs, and also right in the middle of its gap from February. To fill that gap, META would have to trade down an additional 3%.

Given its enormous market cap, META’s decline is contributing to a decline of nearly 1% in the Nasdaq 100 this morning. That would only take the ETF back to a level it was trading at on Monday, and the next level of support doesn’t come into play until about $412, or about 2.5% below current levels. With stocks like Alphabet (GOOGL) and Microsoft (MSFT) due to report earnings after the close today, we should find out soon if those support levels will come into play.

Continue reading today’s Morning Lineup.

For much more analysis of global equities and economic readings released this morning, read today’s full Morning Lineup with a two-week Bespoke Premium trial.

The Closer – Immigration & Labor Supply, META Earnings, EIA – 4/24/24

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we start out with a look into the dynamics of immigration and labor supply (page 1). We then review the latest earnings reports including those of Meta Platforms (META) (page 2). Next, we look at durable goods orders (page 3) before closing out with recaps of the 5 year note auction (page 4) and EIA inventory data (page 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Fixed Income Weekly — 4/24/24

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit each week. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed-income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation, and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1-year return profiles for a cross-section of the fixed income world.

Our Fixed Income Weekly helps investors stay on top of fixed-income markets and gain new perspectives on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

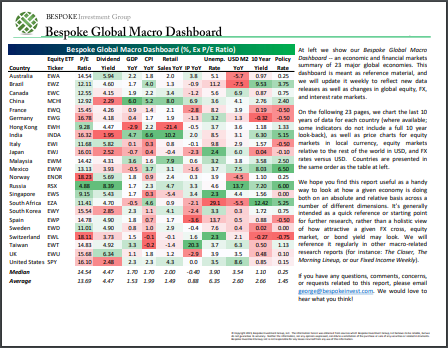

Bespoke’s Global Macro Dashboard — 4/24/24

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published the last Wednesday of every month at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Bespoke’s Morning Lineup – 4/24/24 – So Bad It’s Good

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Any product that needs a manual to work is broken.” – Elon Musk

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Equities are looking to make it three in a row, but skeptics aren’t holding their breath just yet. Driving the gains this morning is Tesla (TSLA), which is up more than 11% in reaction to what pundits have called a “terrible” report. The report was so terrible that this morning’s gap higher at the open will be the largest since October 2019. Whether that’s a reflection of what the pundits know or just how oversold the stock was heading into the report, we’ll leave it for you to decide. The economic calendar is quiet this morning with Durable Goods at 8:30 being the only report. Tomorrow will be a lot busier, though, so enjoy the calm while it lasts. The pace of earnings has been busy and will only get busier after the close when we’ll hear from Chipotle (CMG), Ford (F), IBM, Meta (META), and ServiceNow (NOW) to name a few.

A two-day rally of 2% may not sound that impressive based on how the market traded from November to March but compared to what we have seen so far in Q2, we aren’t turning our noses up on it. While the S&P 500 has rallied over 2% so far this week, on an equal-weighted basis, it’s up just 1.70%. Below we summarize the performance of individual stocks by sector. Not surprisingly, Technology stocks have experienced the most upside with an average gain of 2.50%, and right behind, stocks in the Health Care and Consumer Discretionary sector have seen average gains of over 2%. The only other sectors that have experienced better than average returns are Industrials (1.97%) and Real Estate (1.95%). To the downside, Materials is the only sector where the average stock is lower (-0.58%), but every other sector has averaged gains of at least 1%.

Continue reading today’s Morning Lineup.

For much more analysis of global equities and economic readings released this morning, read today’s full Morning Lineup with a two-week Bespoke Premium trial.

Bespoke’s Morning Lineup – 4/23/24 – Earnings Picking Up

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“You speak an infinite deal of nothing.”– William Shakespeare

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

If you missed yesterday’s segment on CNBC’s Overtime, check it out here.

Some of the positive tone from yesterday’s gain has followed through to this morning as equity futures are modestly higher and gold and oil both continue to give up ground. Yields are higher, so we couldn’t quite get the trifecta, but two out of three isn’t bad. Earnings reports have finally taken the spotlight, and this morning’s results have been positive with encouraging reports from General Motors (GM) and UPS. After the close, we’ll hear from Tesla (TSLA), Texas Instruments, and Visa (V). On the economic calendar, today’s reports include S&P PMIs for the Manufacturing and Services sector, New Home Sales, and the Richmond Fed reports.

A lot of the noise coming from the market is ultimately meaningless, but investors crave to find a cause for every effect. Analysts have blamed everything from the tax deadline to geopolitics, higher rates, or an overbought market. The fact that gold and the dollar – two of the biggest haven assets – both rallied throughout much of the decline suggests that geo-political concerns could have been a large factor. If, as gold’s price suggests, these anxieties are easing, it could bode well for future market performance.

Whatever the cause, 5% pullbacks in the stock market are incredibly ordinary. Since WWII, there have been 230 different periods where the S&P 500 declined 5% or more on a closing basis without a gain of 5% in between. That works out to once every four months, and besides the one we’re dealing with now (so far), every one of them has been followed by a new high. Some new highs took longer than others to achieve, but eventually, the market got there.

Yesterday was an interesting day for the market. The S&P 500 opened higher, quickly sold off in the morning, gave up nearly all its early gains, and then rallied into early afternoon only to drift lower into the close. For a nervous investor watching every tick, the emotional swings probably went something like the comments in the chart below.

We have no idea whether Friday’s close was the low point of this month’s decline, but what we can tell you is that yesterday’s intraday pattern is very common and the type of action you often see as the market is coming out of a low point in the decline. Going back over the last 30 years, we looked at the intraday performance of the S&P 500 tracking ETF (SPY) on the first trading day after the closing low of each of the 106-prior 5%+ S&P 500 declines. On a median basis, SPY has gapped up 0.58% at the open, but at some point, the market tended to dip and shake out the weak hands. At the intraday low, SPY’s median decline was 0.18% versus the prior day’s close, but it tended to finish the day with a median gain of 1.75%. Even though that first trading day after a closing low was positive, the median decline at the close from the intraday high was 0.36%. In other words, roller coaster patterns like Monday’s intraday chart frequently follow a market low.

Continue reading today’s Morning Lineup.

For much more analysis of global equities and economic readings released this morning, read today’s full Morning Lineup with a two-week Bespoke Premium trial.

Bespoke’s Morning Lineup – 4/22/24 – Fool Me Once, Shame On You…

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The people who were trying to make this world worse are not taking the day off. Why should I?” – Bob Marley

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Can we finally get an up day today? Equity futures are higher this morning, but as the last week has shown, that means nothing. There’s not much of a catalyst for the rally this morning, besides the market reaching short-term oversold levels. The only economic report on the calendar is the Chicago Fed National Activity Index, and even though this week’s earnings calendar is jammed-packed, today is relatively quiet with Verizon (VZ) and Truist (TFC) being the only major reports so far. After the close, things will also be relatively quiet, but we will get reports from SAP (SAP), Nucor (NUE), Cleveland-Cliffs (CLF), and Ameriprise Financial (AMP).

The S&P 500 had its worst week in over a year (-3.05%), so you would think that pretty much everything was down on the week. That wasn’t the case, though. In the S&P 500, there were actually 179 stocks that finished higher on the week (35.8% of the index), and four of the eleven sector ETFs finished the week higher. Utilities (XLU) and Consumer Staples (XLP) were both up over 1%, Financials (XLF) were up nearly 1%, and Health Care (XLV) was marginally higher. Granted, these aren’t the leadership sectors that market rallies are made of, so you know it’s a tense environment whenever you see defensive sectors leading, but it does show that investors aren’t just exiting equities en masse.

On the downside, the big drag was Technology. With a drop of over 6%, the sector had its worst week since early November 2022 just as the sector was bottoming. Behind Technology, Consumer Discretionary (XLY) and Real Estate (XLRE) were both crushed with declines of over 3.5%.

Technology is the biggest sector in the market, and its chart has started to show signs of breaking down. After last Monday’s break below the 50-DMA, the sector hasn’t been able to come up for air since, and it’s now trading closer to its 200-DMA than its 50-DMA. One potential silver lining is the fact that last Friday’s decline came to a close right at levels that coincide with the high before the late December peak that was followed by a brief but sharp pullback of nearly 5%. For comparison, the current decline in the sector has been nearly twice that at roughly 9%.

Continue reading today’s Morning Lineup.

For much more analysis of global equities and economic readings released this morning, read today’s full Morning Lineup with a two-week Bespoke Premium trial.

Bespoke’s Brunch Reads – 4/21/24

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market-related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

On This Day in History:

The Surgeon’s Photograph: On April 21st, 1934, 90 years ago today, the Daily Mail published the “Surgeon’s Photograph” depicting the Loch Ness Monster. Captured by Dr. Robert Kenneth Wilson, a London gynecologist, the photograph showed what looked like the head and neck of a serpent-like creature emerging from the waters of Loch Ness in Scotland. For decades, the picture captivated the public and fueled speculation about the existence of a mysterious aquatic creature. Depending on your perspective, fortunately, or unfortunately, a hoax. The photograph is really a toy submarine attached to wood putty in the shape of a sea serpent’s head, but tough to tell in a low-quality photo from the thirties! We’ve come a long way with media and image quality, especially with smartphones and the introduction of AI. So, how tough would it be to pull something like this off today?

AI & Technology

Microsoft’s AI Copilot Is Starting to Automate the Coding Industry (Bloomberg)

Microsoft’s AI Copilot, developed by GitHub using OpenAI’s GPT-4 technology, is revolutionizing the coding industry by automating routine tasks and allowing software engineers to focus on more complex problems. The ability to complete and translate code across programming languages is saving engineers hundreds of hours each month. This tool has garnered over 1.3 million users, including businesses like Goldman Sachs and Ford, helping GitHub stay competitive against rivals like Amazon and Google. Despite its benefits, Copilot still has limitations, such as occasionally generating outdated or buggy code, and requires careful usage by developers. [Link]

Crucial connection for ‘quantum internet’ made for the first time (Phys.org)

Researchers have successfully produced, stored, and retrieved quantum information for the first time. Quantum information is a bit like the data stored in your computer but operates under the rules of quantum mechanics, which allows it to behave in ways that regular computer data can’t. This breakthrough overcomes a big hurdle. Usually, quantum information gets lost or degrades when sent over long distances, just like a phone call might drop out in a tunnel. By using devices compatible with each other, information can be sent through existing telecom fibers, showing that it’s possible to build networks that can effectively handle this special type of information. [Link]

If you’ve got an EV, Google Maps is about to become much more valuable (Washington Post)

Google has announced updates to its Maps app to improve support for EV drivers, including a new tool to locate nearby charging stations with real-time availability and charging speeds. If you drive an EV, you know that “range anxiety” can be a real thing. Well, the updates also feature route planning for long trips with integrated charging stops and detailed navigational aids for locating chargers in complex places like parking garages and hotels. [Link]

Google who? Gen Z is searching on TikTok, YouTube instead (Axios)

Gen Z is turning its back on Google Search and instead using social media platforms like TikTok and Reddit for searches. This shift highlights their preference for quick, relatable content and their skepticism towards Google’s algorithm, which often prioritizes sponsored content. While Google still leads in overall search usage, the trend among younger users (18-24 years old) suggests a significant change in how information is accessed online. Have you tried some of the AI features out there in place of Google like ChatGPT, Snapchat’s AI, or even Meta’s brand-new Llama 3? [Link]

Meta adds its AI chatbot, powered by Llama 3, to the search bar across its apps (TechCrunch)

Speaking of Meta’s brand-new Llama 3, the social media giant has integrated its latest language model into the search functionalities of its primary apps including Facebook, Messenger, Instagram, and WhatsApp. Alongside this, Meta has introduced a new website, meta.ai, for easier access to its AI chatbot, and added features like faster image generation and the ability to transform images into GIFs. However, the widespread use of AI across its platforms raises concerns about content moderation, given the potential for AI to generate misleading responses. [Link]

Jamie Dimon Has a New Vision for Money in an AI World (BNN Bloomberg)

JPMorgan’s CEO, Jamie Dimon, envisions a future where AI enhances every aspect of the banking industry from trading, research, equity hedging and customer service, often as a “co-pilot.” Comparing AI’s impact to historical innovations like the printing press and electricity, JPMorgan is integrating AI to boost productivity and improve the quality of life for workers, but some jobs will be lost according to Dimon. Despite the push for a financial “super app” similar to those in China, Dimon foresees a trend towards multiple specialized apps in the US. When it comes to picking stocks though, Dimon doesn’t see AI being able to replace humans and pick flawlessly. [Link]

Wait, When Did the Schlubs of Silicon Valley Learn to Dress? (WSJ)

The tech industry has been known for its “disruptive” persona embodied by the style choices of executives like Mark Zuckerberg and Jeff Bezos. Meta’s CEO, Zuckerberg, has long opted for a look that is about as dressed down as it gets, but recently, he’s been appearing in much more conventional and refined attire for those of his status. Perhaps the change in appearance has to do with increased competition and regulatory issues in the tech industry. TikTok’s Shou Zi Chew and Nvidia’s Jensen Huang are going for more mature and respectable styles as well, as a more polished appearance could help project stability and professionalism. [Link]

Environmental

Dubai’s Extraordinary Flooding: Here’s What to Know (New York Times)

Recent heavy rains in the United Arab Emirates and Oman have caused unprecedented flooding, leading to at least 21 deaths, submerged vehicles, clogged highways, and severe disruptions at Dubai’s airport. Despite the Arabian Peninsula’s low annual rainfall, it often comes in severe bursts, and global warming could make such extreme downpours more frequent and intense. The UAW also employs cloud seeding, a process that attaches tiny particles to clouds to enhance rainfall, but its impact on these specific storms remains unclear. The flooding of cities in arid regions like Sharjah shows how they are often ill-prepared for so much rainfall, lacking adequate drainage systems. [Link]

Record breaker! Milky Way’s most monstrous stellar-mass black hole is sleeping giant lurking close to Earth (Video) (Space.com)

The Milky Way has revealed a new stellar-mass black hole, discovered close to Earth and named Gaia-BH3. Found using the European space telescope Gaia, this black hole is 33 times the mass of our sun and is just 2,000 light-years away, making it the second-closest black hole to Earth ever discovered. Unlike the supermassive black holes, Gaia-BH3 formed from the collapse of a massive star, offering unique insights into the population of dormant stellar black holes in our galaxy. [Link]

Economic Trends

Million-Dollar Analyst Jobs at Risk in China Research Pullback (Yahoo Finance)

Due to a prolonged market downturn and stricter regulations in China, firms are cutting costs by reducing staff, slashing bonuses, and imposing stricter performance metrics. For example, Guotai Junan Securities saw several senior analysts resign rather than accept pay cuts, and another brokerage in Shenzhen laid off 40% of its analysts. That’s a sharp U-turn from previous years when brokerages were expanding and offering high salaries to attract top talent. Additionally, policy changes that reduce trading fees and restrict paid research have further pressured the industry. These challenges are compounded by a general wariness among investors toward Chinese stocks, leading to a decreased demand for equity research. [Link]

Investments

The Headache at the End of the Costco Gold Rush (WSJ)

We’ve discussed the Costco gold bars here before, but selling them proves to be much more challenging than buying them. One buyer bought a gold bar for $2,000 and struggled to sell it close to market value, eventually settling for $1,960. Despite high consumer interest in gold as a hedge against inflation, the reality is that gold is not very liquid, and sellers often face immediate losses due to transaction fees and market discounts, nor does Costco offer buybacks or returns on its gold bars! [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!