The Closer – Immigration & Labor Supply, META Earnings, EIA – 4/24/24

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we start out with a look into the dynamics of immigration and labor supply (page 1). We then review the latest earnings reports including those of Meta Platforms (META) (page 2). Next, we look at durable goods orders (page 3) before closing out with recaps of the 5 year note auction (page 4) and EIA inventory data (page 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Daily Sector Snapshot — 4/24/24

Q1 2024 Earnings Conference Call Recaps

Bespoke’s Conference Call Recaps provide helpful summaries of corporate conference calls throughout earnings season. We go through the conference calls of some of the most important companies in the market and summarize key topics covered by management. These recaps include information regarding each company’s financial results, growth by segment, as well as some aspects of the business that management expects to impact future results. We also identify trends emerging for the broader economy in these recaps.

Bespoke’s Conference Call Recaps are available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call recaps. To sign up, choose either the monthly or annual checkout link below:

Bespoke Institutional – Monthly Payment Plan

Bespoke Institutional – Annual Payment Plan

Below is a list of the Conference Call Recaps published during the Q1 2024 and Q4 2023 earnings reporting periods.

Q1 2024 Recaps:

Tesla: Q1 2024

PepsiCo: Q1 2024

Cadence Design: Q1 2024

American Express: Q1 2024

Netflix: Q1 2024

D.R. Horton: Q2 2024

CSX: Q1 2024

Las Vegas Sands: Q1 2024

United Airlines: Q1 2024

ASML: Q1 2024

Big Banks (JPM, C, GS, BAC, MS): Q1 2024

Delta Air Lines: Q1 2024

Lamb Weston: Q3 2024

Conagra Brands: Q3 2024

Q4 2023 Recaps:

Williams Sonoma: Q4 2023

Nordstrom: Q4 2023

AeroVironment: Q3 2024

Aaron’s: Q4 2023

NVIDIA: Q4 2024

Walmart: Q4 2024

Home Depot: Q4 2023

Deere: Q4 2023

Generac: Q4 2023

Airbnb: Q4 2023

AutoNation: Q4 2023

Restaurant Brands International: Q4 2023

Shopify: Q4 2023

Cloudflare: Q4 2023

Hershey: Q4 2023

Disney: Q1 2024

Arm: Q3 2024

Uber: Q4 2023

Chipotle: Q4 2023

Spotify: Q4 2023

Simon Property: Q4 2023

Palantir: Q4 2023

Caterpillar: Q4 2023

McDonald’s: Q4 2023

Apple: Q1 2024

Amazon: Q4 2023

Meta Platforms: Q4 2023

Honeywell: Q4 2023

Old Dominion Freight: Q4 2023

Starbucks: Q1 2024

Microsoft: Q2 2024

United Parcel Service: Q4 2023

Alphabet: Q4 2023

Whirlpool: Q4 2023

Super Micro Computer: Q2 2024

Norfolk Southern: Q4 2023

American Express: Q4 2023

IBM: Q4 2023

Tesla: Q4 2023

ASML: Q2 2024

Texas Instruments: Q4 2023

Netflix: Q4 2023

RTX: Q4 2023

3M: Q4 2023

General Electric: Q4 2023

Schlumberger: Q4 2023

PPG Industries: Q4 2023

Taiwan Semiconductor: Q4 2023

H.B. Fuller: Q4 2023

Fastenal: Q4 2023

Big Banks (JPM, C, BAC, GS): Q4 2023

Delta Air Lines: Q4 2024

Constellation Brands: Q3 2024

Conagra Brands: Q2 2024

Lamb Weston: Q2 2024

Walgreens: Q1 2024

FedEx: Q2 2024

Costco: Q1 2024

Brown-Forman: Q2 2024

SentinelOne: Q3 2024

Recaps published during Q1 2024 are available with a Bespoke Institutional subscription.

Fixed Income Weekly — 4/24/24

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit each week. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed-income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation, and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1-year return profiles for a cross-section of the fixed income world.

Our Fixed Income Weekly helps investors stay on top of fixed-income markets and gain new perspectives on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

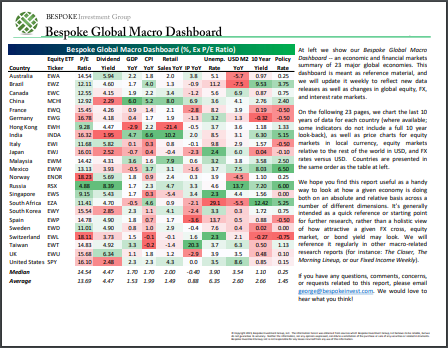

Bespoke’s Global Macro Dashboard — 4/24/24

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published the last Wednesday of every month at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Chart of the Day: Gains Get Erased

Bespoke’s Morning Lineup – 4/24/24 – So Bad It’s Good

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Any product that needs a manual to work is broken.” – Elon Musk

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Equities are looking to make it three in a row, but skeptics aren’t holding their breath just yet. Driving the gains this morning is Tesla (TSLA), which is up more than 11% in reaction to what pundits have called a “terrible” report. The report was so terrible that this morning’s gap higher at the open will be the largest since October 2019. Whether that’s a reflection of what the pundits know or just how oversold the stock was heading into the report, we’ll leave it for you to decide. The economic calendar is quiet this morning with Durable Goods at 8:30 being the only report. Tomorrow will be a lot busier, though, so enjoy the calm while it lasts. The pace of earnings has been busy and will only get busier after the close when we’ll hear from Chipotle (CMG), Ford (F), IBM, Meta (META), and ServiceNow (NOW) to name a few.

A two-day rally of 2% may not sound that impressive based on how the market traded from November to March but compared to what we have seen so far in Q2, we aren’t turning our noses up on it. While the S&P 500 has rallied over 2% so far this week, on an equal-weighted basis, it’s up just 1.70%. Below we summarize the performance of individual stocks by sector. Not surprisingly, Technology stocks have experienced the most upside with an average gain of 2.50%, and right behind, stocks in the Health Care and Consumer Discretionary sector have seen average gains of over 2%. The only other sectors that have experienced better than average returns are Industrials (1.97%) and Real Estate (1.95%). To the downside, Materials is the only sector where the average stock is lower (-0.58%), but every other sector has averaged gains of at least 1%.

Continue reading today’s Morning Lineup.

For much more analysis of global equities and economic readings released this morning, read today’s full Morning Lineup with a two-week Bespoke Premium trial.