Aug 20, 2020

Amazon (AMZN) is up to 5.7% of the S&P 500’s market cap. While other large tech-adjacent names have had a similarly large impact on the aggregate market this year, the e-commerce giant remains somewhat unique for its scale and penetration into every possible market. At the same time, it’s interesting to note that many other retailers have been able to thrive in this environment. Target (TGT), Wal-Mart (WMT), Home Depot (HD), and Lowe’s (LOW) are all examples of retailers that have leveraged a combination of unique offerings and extremely rapid digital sales growth. 100% YoY sales growth for digital channels is the norm for many major retailers at this point. Unfortunately, while some companies have been able to thrive in the current environment, smaller and more specialized retailers haven’t been able to drive traffic as well. Two recent de-listings removed from our index this month (ASNAQ and TLRDQ) are examples of stocks that haven’t been able to keep up.

Our “Death By Amazon” index was created many years ago to provide investors with a list of retailers we view as vulnerable to competition from e-commerce. In 2016, we also created our “Amazon Survivors” index which is made up of companies that look more capable of dealing with the threat from online shopping. To see how the two indices have been performing lately and view the full list of stocks that make up the indices, please read our newest report on the subject available to Bespoke Premium and Bespoke Institutional members.

To unlock our “Death By Amazon” and “Amazon Survivors” indices, login or start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Jul 9, 2020

So far this year, Amazon has added $620bn to its market cap versus $1.12 trillion in market cap declines for the rest of the current S&P 500 membership that was trading at the end of 2019. 357 companies have seen declines in market cap YTD, totaling $3.3trn. In short, equity market cap is consolidating dramatically into the top of the index. A similar process has been underway in economic data. For Q1, the Census reported e-commerce sales topped 11% of total retail sales for the first time, a 0.5% increase versus Q4 of 2019. That increase in share was the largest ever and is indicative of how much market share is being gobbled up by Amazon and a few other e-commerce giants. From an equity market return perspective, huge gains for Amazon are totally consistent with the big underperformance of our Death By Amazon Index over the past few months. Distress leading to de-listings has also mounted, as measured by four different names coming out of our Death By Amazon Index this month.

Our “Death By Amazon” index was created many years ago to provide investors with a list of retailers we view as vulnerable to competition from e-commerce. In 2016, we also created our “Amazon Survivors” index which is made up of companies that look more capable of dealing with the threat from online shopping. To see how the two indices have been performing lately and view the full list of stocks that make up the indices, please read our newest report on the subject available to Bespoke Premium and Bespoke Institutional members.

To unlock our “Death By Amazon” and “Amazon Survivors” indices, login or start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Apr 16, 2020

Our “Death By Amazon” index was created many years ago to provide investors with a list of retailers we view as vulnerable to competition from e-commerce. In 2016, we also created our “Amazon Survivors” index which is made up of companies that look more capable of dealing with the threat from online shopping. To see how the two indices have been performing lately and view the full list of stocks that make up the indices, please read our newest report on the subject available to Bespoke Premium and Bespoke Institutional members.

To unlock our “Death By Amazon” and “Amazon Survivors” indices, login or start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Dec 26, 2019

Our “Death By Amazon” index was created many years ago to provide investors with a list of retailers we view as vulnerable to competition from e-commerce. In 2016, we also created our “Amazon Survivors” index which is made up of companies that look more capable of dealing with the threat from online shopping. To see how the two indices have been performing lately and view the full list of stocks that make up the indices, please read our newest report on the subject available to Bespoke Premium and Bespoke Institutional members.

To unlock our “Death By Amazon” and “Amazon Survivors” indices, login or start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Oct 24, 2019

On Monday, we updated our popular Death By Amazon index. The index is composed of retailers that we view as most vulnerable to competition from online retail like Amazon (AMZN).

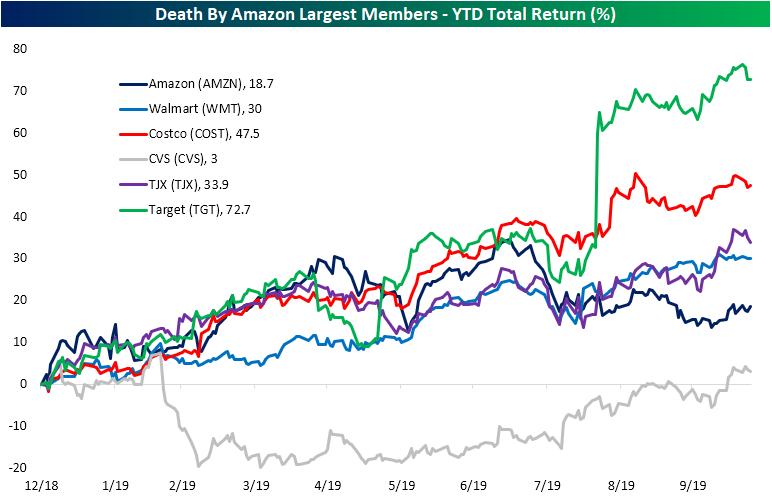

Looking at year-to-date total returns of the largest five (by market cap) members of our Death By Amazon index, Target (TGT) has ran away from the rest of the group in 2019. Including dividends, the stock has netted a 72.7% gain since the start of the year in large part due to the massive surge on earnings in the late summer. Close competitor and the largest retailer in the index, Walmart (WMT), has given investors less than half of that as WMT has returned 30% thus far in 2019. Before the earnings report that sent TGT skyrocketing, Costco (COST) had been a close contender for the highest returning spot. Currently, COST has the second best YTD return at 47.5% with TJX in third at 33.9%. On the other hand, CVS has dramatically underperformed only providing a return of 3%. Meanwhile, the namesake of the index, AMZN, actually has the second worst return in 2019 of just 18.7% YTD. Earlier this year in the spring, AMZN had actually returned the most.

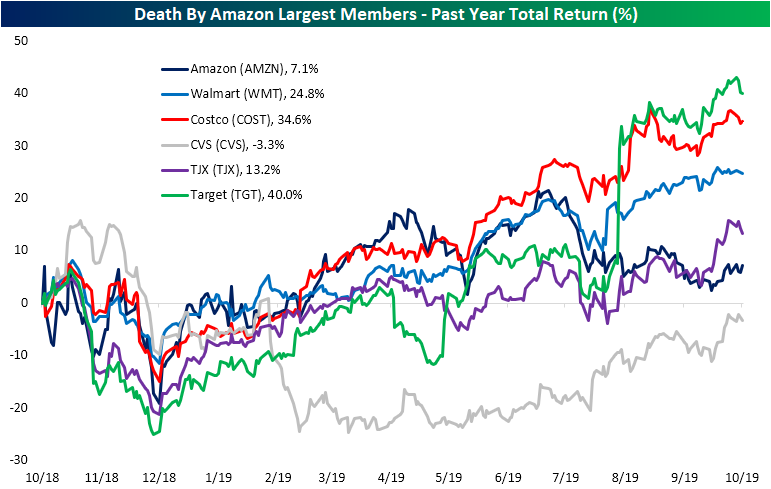

Over the past year, AMZN’s return looks even worse. Since October of last year, the stock has only returned 7.1%. While better than CVS’s 3.3% loss, each of the other largest stocks in the Death By Amazon index have offered investors more.

But over the long term, as the trend of online retail has matured, Amazon (AMZN) has offered investors a far higher return. Total return for the stock over the past five years is 514.9%. That is nearly three times more than the next best stock of these, Costco (COST), which has returned 158.5%. Start a two-week free trial to Bespoke Premium to access our Death By Amazon index as well as other B.I.G. Tips reports, interactive tools and more.